Why Loan Department Ask For Cancelled Cheque? Know Here

What is a cancelled cheque?

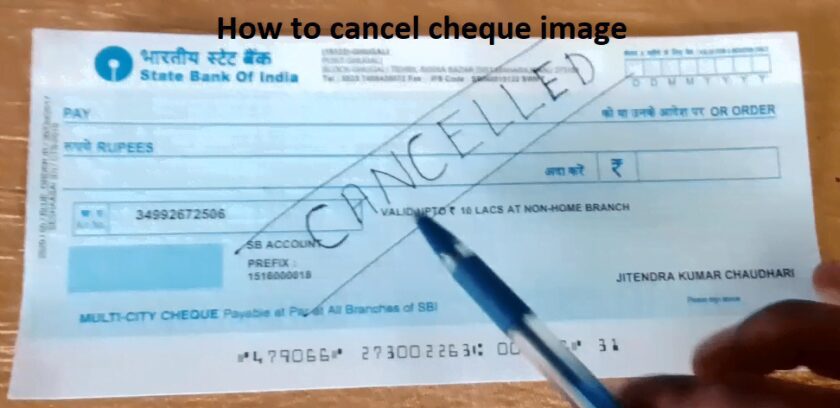

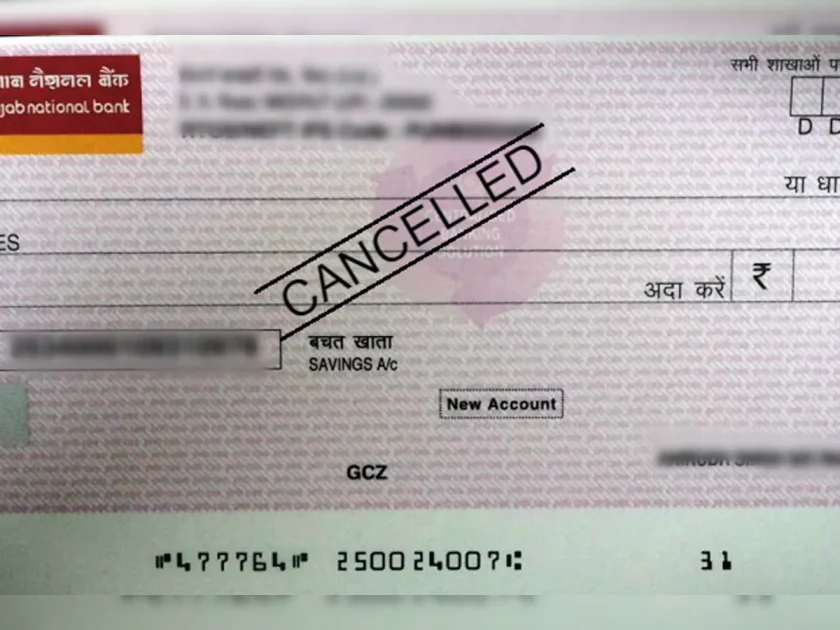

A cheque is called a ‘cancelled cheque’ when two lines are drawn across it and the word “cancelled’ is written between the two lines.

This cheque cannot be used to withdraw money as the words explicitly mean it has been cancelled.

How to cancel a cheque?

To cancel a cheque, you need to strike two lines across the cheque and write the word “Cancelled” across it. You don’t need to sign the cancelled cheque.

It only works as proof that you have an account in the bank.

The account holder’s name, branch name and address, account number and MICR Code are on the cheque, which is enough to submit as proof. Also Read, Fox And Verizon New Multi-Year Distribution Deal That Adds Fox Weather And Tubi

Also Read, German insurance company Allianz on Friday posted a 23% fall in second-quarter net profit

What are the uses of a cancelled cheque?

As mentioned above, a cancelled cheque proves that you have an account in that particular bank. Given below are a few instances where you may be required to submit a cancelled cheque-

- The bank will ask you to submit a cancelled cheque when you take any home loan, car loan, personal loan, etc.

- When you take a durable consumer loan from a store when making big-ticket transactions and choose to deduct EMIs on standing instruction, the financial provider will ask for a cancelled cheque.

- When investing in mutual funds, the investment organizations emphasize the most on verifying the KYC Details of the customer. So to verify your account details, you will be required to submit the cancelled cheque.

- When you want to withdraw your provident fund through the offline method, you must submit the cancelled cheque along with the other documents to verify that the account details mentioned on the form belong to you and not anyone else.

- A cancelled check is also needed to register for Electronic Clearance Service, which automatically deducts the amount from your bank account.

- When purchasing an insurance policy, the insurance company asks you to submit your cancelled cheque.

Also Read, All You Want To Know About FTX NFT Marketplace 2022

When would you need a cancelled cheque?

You may have to submit a cancelled cheque in the following cases:

- Mutual Funds: If you are investing in mutual funds or the stock market, you must open a Demat account. The company would want you to submit a cancelled cheque to open the account to verify if the bank account associated with the investment is yours in reality. The requirement of the cancelled cheque is by the Know Your Customer (KYC) guidelines.

- EMI: Equated Monthly Instalments (EMI) is the most sought-after payment method when buying a gadget or a high-value item. Individuals pay monthly instalments even in the case of loans such as car loans, home loans, education loans, and personal loans. To initiate the process of monthly instalments, you must submit a cancelled cheque as proof of having a bank account.

- Electronic Clearance Service: An electronic clearance service automatically deducts money from your account monthly for any transaction you have done. In this case, you must set up the electronic clearance service.

- Provident Fund Withdrawal: Companies generally ask for a cancelled cheque when you want to withdraw your EPF money.

- Insurance Policy: A cancelled cheque is required even when purchasing an insurance policy.

How to write a cancelled cheque?

It is easy to write a cancelled cheque. It does not require extensive information, so anyone with a pen can write one. Keep these pointers in mind if you want to write a cancelled cheque:

- Take a new cheque.

- Do not write any information on the cheque, such as the Payee’s name, the amount, or signature.

- Across the check, draw two parallel lines.

- Between the two parallel lines, write “CANCELLED” in capital letters.

- Ensure that the parallel lines do not obscure vital information, like the account number, IFSC code, MICR code, account holder’s name, bank’s name, or location.

Also Read, United Kingdom Banks cut mortgage offers amid the economic panic

When do you need a cancelled cheque?

A cancelled cheque is more valuable than you might think. Here are some of its most common uses:

- You must present a cancelled check when investing in stocks, mutual funds, or other financial assets. You cannot start investing without one.

- If you want to make a withdrawal from your EPF account, you will need to provide a cancelled cheque.

- ECS stands for Electronic Clearance Service. It allows you to move money from one account to another. You will need to send a cancelled cheque to your bank to activate this service on your account.

- Before settling your EMI payments against an obtained loan or credit amount, your bank or NBFC will need a cancelled cheque.

- If you wish to open a Demat account, you must submit a cancelled cheque and additional KYC papers such as proof of identification, address, and so on.

- When purchasing insurance, you must present a cancelled cheque as verification.

Nobody can withdraw money using a cancelled cheque, but people can still use it for fraudulent acts. To be safe, do not sign a cancelled cheque and always hand it over to an authoritative figure. A cancelled cheque still has information like your bank account number, MICR code, IFSC code, bank name, account holder’s name, and so on.

Always ensure your signature is not affixed to a cancelled cheque; otherwise, fraudsters may be able to duplicate it. If a signature on the cheque leaf is mandated, get a statement or affirmation to support the same.

Also Read, SBI Q1 Net profit of Rs 6,068 crore, misses out on estimates

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic and for informational purposes only.

Follow us or bookmark us for more Technology News Celeb Bio box office collection report celebrities trailers and promos

Join us on Facebook

Join us on Twitter